Parmita Uniyal

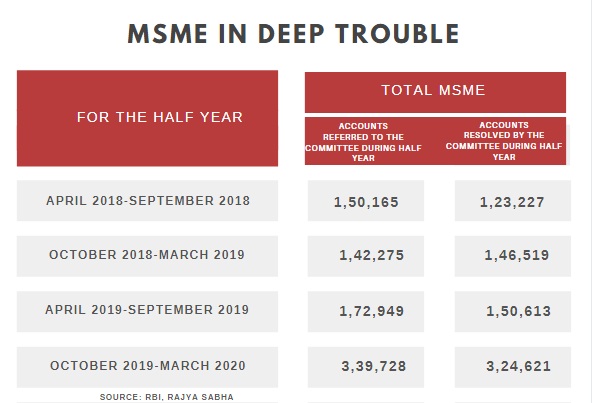

New Delhi: Pandemic-hit micro, small and medium enterprises (MSMEs) could be the worst nightmare for banks and indeed a ticking time bomb. The number of firms facing challenges in repaying loans to banks rose 96% in the half year period ending March 2020, the pre-Covid period.

The latest official data shows that the number of stressed MSME accounts referred to a RBI mandated panel nearly doubled in half year ended March 2020 to 3,39,728 from 1,72,949 in April-September 2019.

Given that the exponential rise in troubled accounts is for the period just before pandemic started taking toll on the economy, the numbers April onward could be far more worrying.

The MSME sector has been crying for help from the government as the double blow of demand slump and cash crunch has spelled doom for it. While industry watchers estimate that nearly 10% of the 6.3 crore MSMEs in the country might have folded up during the pandemic, there is no government data on closures in the sector.

As per 73rd round of National Sample Survey (NSS) (July 2015- June 2016) conducted by Ministry of Statistics & Programme Implementation (MoSPI), the MSME sector employs nearly 11.10 crore people. It contributes 30% to the country’s GDP which is estimated to be about Rs 200 lakh crore.

Replying to a question in Rajya Sabha last week, the MSME Ministry said there were no records available on firms shuttered during March-August period of the current year.

Worse, it could not provide data on small firms shut down in previous years. This raises questions over the efficacy of policy measures as targeted action can not be taken in absence of insufficient or no official data.

The poor data quality has been a major concern in the MSME sector. Even as data is compiled to cover various aspects it comes with considerable time lag. As per Central Statistics Office, the MSME sector contributed 30.3% in the country’s GDP and 37.3% of manufacturing output during 2018-19.

The share of MSME related products accounted for 49.8% of the country’s total exports in FY20, according to Directorate General of Commercial Intelligence & Statistics (DGCIS).

“COVID-19 epidemic has temporarily affected various sector including Micro, Small and Medium Enterprises,” Minister of State for MSMEs Pratap Chandra Sarangi said in a written reply in Rajya Sabha.

Industry estimates suggest massive job losses in the sector in the last five months and firms are planning to cut operations and employee strength to stay afloat. While government has opened the economy after the most draconian lockdown in the world, consumer demand has been lackluster. This has resulted in stocks piling up in factories and capital remaining stuck.