Chirag Nangia

Income Tax Return (ITR) is a report in which taxpayers furnish information as to their total income and tax payable. The taxpayers are required to disclose particulars of income earned under different heads, deductions from the gross total income and the resultant tax payable. This Return Form serves as a source of information for the taxmen, to detect black money and possible evasion.

The tax department has revamped the return forms, time and again, to seek more and more information from the taxpayers so as to catch hold of tax evaders and bring more people under the tax net. Another reason for soliciting more information may be that government is slowly moving towards e-assessment and thus wishes to obtain greater clarification from the taxpayers in the return itself so as to save time and cost.

Mandatory filing of Return: the Basic Exemption Limit and other decisive factors

Individual taxpayers are required to file tax returns compulsorily, before the due date, if their gross total income of the financial year, as computed in accordance with the provisions of the law, surpasses the basic exemption limit.

The exemption limit for the assessment year 2020-21 for an individual is INR 2.50 lakh. For resident senior citizens (60 years or more) and super senior citizens (80 years or more), this exemption limit has been pronounced as INR 3 lakh and INR 5 lakh, respectively. The gross total income is computed by adding up income under all heads without accounting for investment-linked deductions under chapter VI A (i.e. section 80C to 80U) or deduction under section 54/54F/54EC, etc.

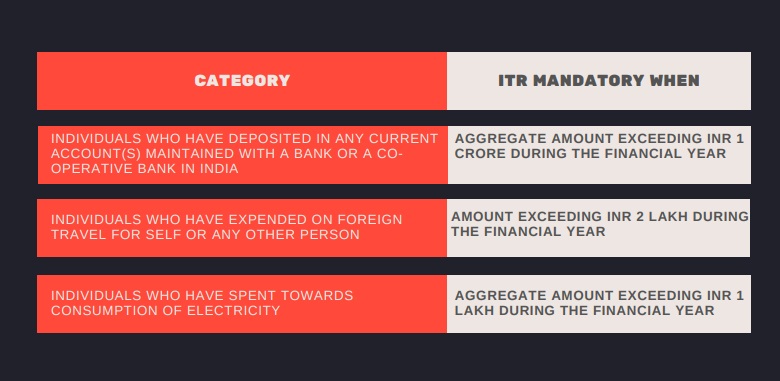

There are certain categories of individual taxpayers for whom furnishing of ITR is mandatory, irrespective of whether their income exceeds the exemption limit:

Non-residents and Foreign asset holders

Non-resident individuals are taxable in India on income, which is either received or has accrued/ arisen in India. Thus, an individual non-resident, having India-sourced income, exceeding the basic exemption limit (currently INR 2.5 Lakh, irrespective of age) is required to file the ITR.

Additionally, a resident individual, holding any asset outside India, either in individual capacity or in his capacity as beneficial owner, is required to file ITR even if his total income is below the basic exemption limit.

File ITR if you have a refund claim or wish to carry forward losses

Interestingly, filing of ITR is necessary for carrying forward any losses sustained during the year for set-off in subsequent years. Likewise, an individual whose income has suffered deduction of tax at source (TDS), but his final tax liability is below taxable limit must file the Return of income to claim refund of TDS.

Implications of Form 26AS

Income Tax department accords the taxpayers a statement in Form 26AS essentially containing details of various taxes deducted from the income of taxpayers. The CBDT has recently revamped the form to include additional details right from taxpayers’ high-value transactions to information about pending/completed proceedings. Every taxpayer must download their Form 26AS from the income tax portal and check the receipts appearing in the Form 26AS. If income reflected in Form 26AS is more than the basic exemption limit, one must file a tax return to avoid scrutiny assessment.

What if you have opted for the alternative/ new tax regime?

With effect from AY 2020-21, taxpayers have been allowed to opt for an alternative/simpler tax regime, which offers six slabs with low tax rates to taxpayers, if they forego a set of 70 exemptions and deductions available under income tax laws (including LTC, HRA, standard deduction, deduction under chapter VI-A, etc.).

Under this new regime, the basic exemption limit for all individuals will be INR 2.5 lakh, regardless of their age. Consequently, filing of ITR shall be mandatory for all individuals opting to pay taxes under the new regime and having gross total income exceeding INR 2.5 lakh.

Consequences of non-filing of ITR

While filing of income tax return has its benefits, non-filing of the same can lead to penalty and prosecution. Accordingly, it is imperative for a person to check whether or not they are liable to file ITR.

The government has been incessantly trying to simplify the return filing process and provide necessary tools for easy compliance. Appropriate collection and allocation of taxes, helps the government build a robust nation. Filing ITR is a social and moral responsibility of a responsible citizen. Paying their due taxes ensures their fair contribution in the growth of Indian economy.

Chirag Nangia is Director, Nangia Andersen India

Chirag Nangia is Director, Nangia Andersen India

(With inputs from Vasudha Arora)