TLI Staff

New Delhi, September 14

Facing flak over six-year low GDP growth of 5% in April-June quarter, Finance Minister Nirmala Sitharaman on Saturday announced a slew of measures to boost exports and housing sector, the third tranche of measures to propel the economy.

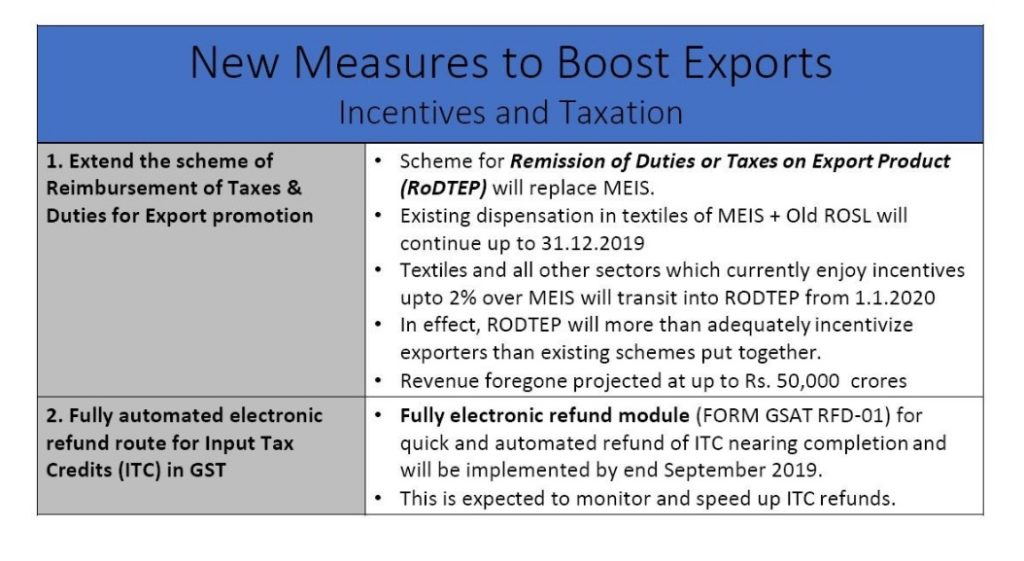

Among the key steps to support exports is launch of a new scheme Remission on duties and taxes on export products (RoDTEP) that would cost the exchequer Rs 50,000 crore. The real estate bail-out plan is to the tune of Rs 10,000 crore which will be used to complete unfinished housing projects in affordable and middle income category.

While maintaining that annual and quarter wise Fixed Investment Rates show revival, Sitharaman promised to implement all the measures for the two job-intensive sectors in time-bound manner.

“Further to budget announcements, fiscal deficit to GDP ratio has been kept up although the current account deficit figures show a bit of a hike,” she said to convince that economy was indeed on the path of recovery.

Signs of Revival

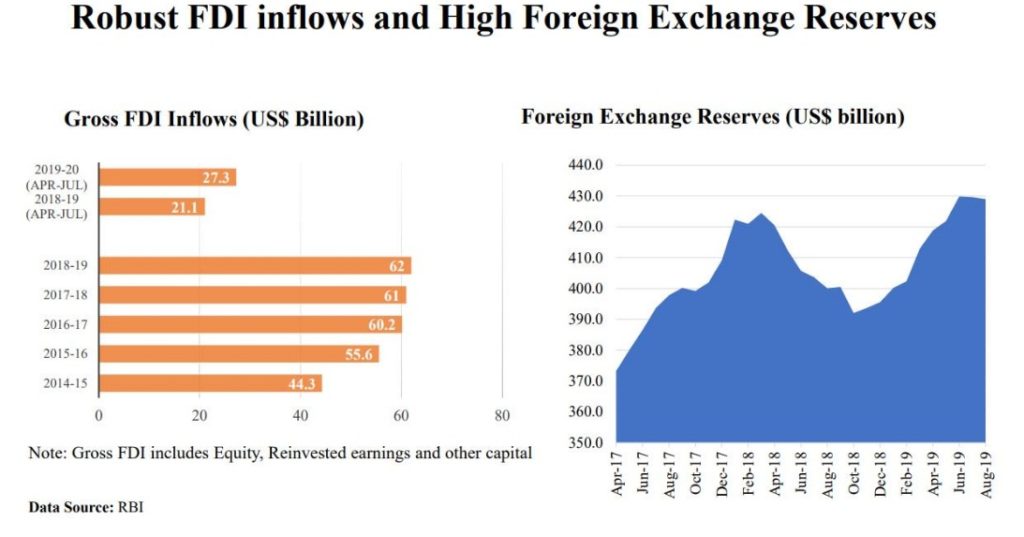

The minister noted that FDI inflows into the country had been robust and forex reserve had gone up in the month of August showing signs of revival. Further, inflation was under control and below 4%.

As India faces global headwinds with US-China trade war continuing and signs of recession in the world economy, Finance Minister lined up several measures to push exports, the key engine of growth. The new initiatives include export finance through expanding the scope of ECIS and offering higher insurance cover to banks’ lending capital for exports. A fully electronic refund mechanism for GST was also announced for exporters.

The government promised to ensure higher credit availability to MSMEs for exports through releasing of an additional Rs 36,000-68,000 crore.

Mayank Jalan, President, Indian Chamber of Commerce lauded the package for exporters and housing companies but hoped government will announce measures for other sectors as well.

“We look forward to similar supportive measures for the automobile sector,” Jalan said.

The Finance Minister announced the fresh set of measures to boost economy after nationwide consultation over the last few weeks. While listing out new measures in a press conference here in the national Capital, she also dwelt upon the follow-up actions over the previous announcements for various sectors including real estate.

Boost for Housing Sector

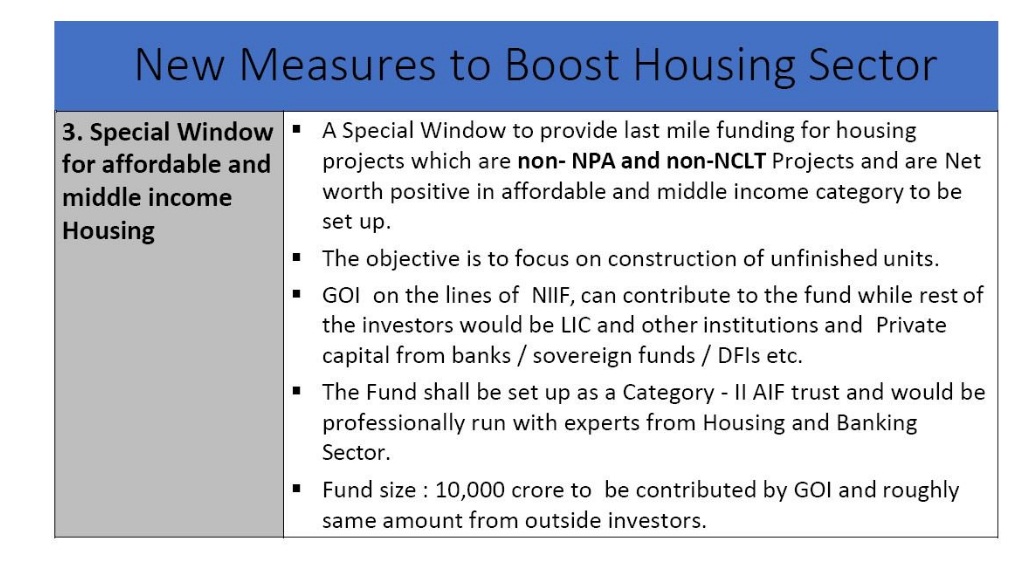

Sitharaman announced to create a special window to provide last-mile funding requirements for housing projects that are non-NPA and non-NCLT but remain stuck due to lack of funding. In order to complete them, government will contribute Rs 10,000 crore towards this.

As per an estimate, there are more than 5.5 lakh units that are stuck or delayed in seven major cities alone.

“The government on the lines of NIIF can contribute to the fund while rest of the investors would be LIC and other institutions and private capital from banks, sovereign funds and DFIs etc,” the Minister said.

Among other measures for the housing sector, Sitharaman announced to relax External Commercial Borrowing (ECB) norms and lowering of Interest rate on House Building Advance. The government will encourage its staff to buy new houses.

“ECB guidelines will be relaxed to facilitate financing of home buyers who are eligible under the PMAY in consultation with RBI. This is in addition to the existing norms for ECB for affordable housing,” she said.

The interest rate on housing building advance will be lowered and linked with the 10 years G-Sec yields.

“Government servants contribute to a major component of demand for houses. It will encourage more government servants to buy new houses,” the Minister said.

While most industry players hailed the government for all the measures they certainly expect more.

“There is a need to change the definition of ‘affordable housing’. At present, the Government of India considers a unit with a price tag of Rs 45 lakh as ‘affordable’. We need to remove the price-cap while defining ‘affordable housing’ and focus on project size. I do not understand the logic why someone would think that Rs 45 lakh is a suitable benchmark for affordable housing, when it makes no sense for projects in Delhi, Mumbai and Chennai,” said Niranjan Hiranandani, President, NAREDCO.

Also read: Modi government fails to deliver on economy, yet again